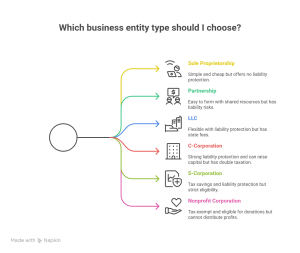

Your choice of business structure affects your taxes, your personal liability, your ability to raise money, and even how you eventually exit the business. Let’s walk through the most common business entity types, explain what they mean in plain language, and weigh the pros and cons of each.

A sole proprietorship is the simplest and most common way to start a business. It’s essentially just you doing business—no separate legal entity.

Pros:

Cons:

Best for: Freelancers, consultants, or very small businesses just testing the waters.

If you’re going into business with one or more people, you may consider a partnership. Partnerships can be general partnerships (GP), where all partners share responsibility, or limited partnerships (LP)/limited liability partnerships (LLP), which give some partners limited liability.

Pros:

Cons:

Best for: Two or more people who trust each other and want to build something together without too much initial complexity.

An LLC combines the liability protection of a corporation with the flexibility of a partnership. It’s one of the most popular options for small and medium-sized businesses.

Pros:

Cons:

Best for: Small to mid-sized businesses that want liability protection but still want flexibility and simplicity.

A corporation is a separate legal entity from its owners (shareholders). Corporations come in two main types: C Corporations (C-Corps) and S Corporations (S-Corps).

Pros:

Cons:

Best for: Businesses planning to scale significantly, seek outside investors, or eventually go public.

Pros:

Cons:

Best for: Small to medium businesses that want corporate liability protection with tax advantages.

If your goal is charitable, educational, or religious rather than profit-driven, you might consider a nonprofit.

Pros:

Cons:

Best for: Organizations formed to serve the public good rather than generate profit.

There’s no one-size-fits-all answer. If you’re just starting small and want to test your idea, a sole proprietorship or partnership might make sense. If you want liability protection without too much red tape, an LLC is often a great choice. For businesses aiming for rapid growth and outside investment, a C-Corporation is usually the way to go. And if your mission is charitable, a nonprofit may be the right path.

The good news is that your choice isn’t permanent—you can change your business structure later as your company grows. The key is to pick the one that fits your goals, risk tolerance, and vision today.

Pro tip: It’s always smart to consult with a business attorney or accountant before making your final decision. They can help you understand how each option applies to your specific situation.

Yes. Many entrepreneurs start as sole proprietors for simplicity and then transition to an LLC or corporation as the business grows and liability risks increase.

Not always. While LLCs offer liability protection and flexibility, some very small businesses may prefer the simplicity of a sole proprietorship, and others might benefit from electing S-Corporation status for tax purposes.

An LLC is a legal entity created at the state level. An S-Corporation is a tax designation that either an LLC or corporation can elect, provided it meets IRS requirements. An LLC can choose to be taxed as an S-Corp, combining liability protection with potential tax savings.

Not necessarily, but it’s highly recommended. While you can file forms online yourself, a lawyer ensures compliance with state laws, helps draft agreements, and tailors the structure to your goals.

C-Corporations are generally preferred by venture capitalists and investors because of their ability to issue different classes of stock and their perpetual structure.

Nathan Moore is a business attorney located in Nashville, Tennessee. Moore Law PC’s entire focus is helping advise and guide entrepreneurs and small business owners in their efforts to be successful in what they do.

By Nathan Moore, Moore Law PC

At Moore Law PC, we’re always looking ahead—so attending the ABA Middle Market and Small Business Committee’s Spring Meeting in New Orleans this year was both a professional investment and a welcome reminder of how much opportunity still exists for our clients.

A highlight of the conference was a data-rich, insightful presentation by Rodger Howell, CEO of Houlihan Capital, on the state of middle-market M&A and private equity trends. As an attorney who works closely with business owners on growth, transition, and exit strategies, I found Rodger’s presentation incredibly valuable. Below, I share the key takeaways I’m now applying in my conversations with clients.

Howell opened by addressing a common misconception: that M&A markets are “cooling off.” In truth, while dollar volumes have declined from the 2021 post-COVID surge, transaction volume remains robust—especially in the lower middle market.

2021 was an outlier, not the benchmark. The current climate reflects historical norms. For founders, that’s good news: you haven’t “missed the window.” You just need a clear strategy and the right advisors.

PE firms are still sitting on significant dry powder, but they’re more cautious about where and how they invest. Instead of chasing inflated deals, they’re favoring platform fits, recurring revenue models, and proven management teams.

One of the most promising trends for our clients is the rise of minority recapitalizations. These structures let owners sell a stake—often 20–40%—to raise growth capital while retaining control. It’s ideal for founders who want to scale without giving up the reins.

Rodger highlighted how more deals now involve rollover equity—where a seller retains a partial stake post-transaction. This setup offers a potential second bite at the apple: founders get liquidity now and participate in the business’s future upside.

At Moore Law PC, we’re seeing increasing interest in this approach. It gives our clients flexibility, continued involvement, and the chance to benefit from value creation under new ownership or with capital infusion.

Rodger’s valuation commentary was especially practical. Multiples are down from 2021 highs but stable and healthy—typically around 6x EBITDA for mid-market companies.

He emphasized the size premium: larger businesses receive higher multiples. That means smart investments in growth or acquisitions today can yield substantial value tomorrow. For clients with a $10M goal in mind, now is the time to think strategically about scale.

Rodger explained that family offices and independent sponsors are now formidable buyers. These groups often bring longer-term outlooks and more flexible deal structures—especially valuable to founders concerned with legacy, culture, or operational continuity.

These buyers can be ideal partners for succession-minded owners or those in specialized sectors like cannabis or regulated industries where institutional capital hesitates.

Ultimately, Rodger reminded us of something we see daily at Moore Law PC: the biggest risks in a deal aren’t just financial—they’re human. Poor succession planning, unresolved family dynamics, or confusion between ownership and control can derail even a perfect offer.

Our role as legal counsel isn’t just to paper the deal—it’s to guide founders through a thoughtful process that respects their goals, protects their interests, and prepares them for what’s next.

Rodger Howell’s presentation confirmed what we’re already seeing on the ground: the middle market is active, evolving, and rich with opportunity. If you’re a business owner thinking about growth capital, succession, or exit planning, there’s no better time to start building your strategy.

At Moore Law PC, we help clients position themselves for success—whether that’s preparing for a sale, scaling to the next stage, or structuring ownership for long-term resilience.

If you’d like to discuss your options, we’re here to help.

Moore Law PC – Business Law for Growth, Transition, and Legacy.

Contact us today to learn more about how we support entrepreneurs and closely held businesses at every stage.

You can also download the PDF slides that accompanied this presentation.

You’ve got questions and we’ve got answers! We know some terminology can be confusing. We’re here to clear the air and give you a complete understanding of what it means to be both an LLC and and S-Corporation.

Q: Can a limited liability company (LLC) elect to be taxed as an S-Corporation?

A: Yes, an LLC can choose to be taxed as an S-Corporation by filing the appropriate forms with the Internal Revenue Service (IRS). This election does not change the entity’s legal structure under state law—it remains an LLC—but it does alter how the business is treated for federal income tax purposes.

Q: What is the benefit of electing S-Corp taxation for an LLC?

A: The primary benefit is the potential reduction in self-employment taxes. In a standard LLC, all business income is typically subject to self-employment tax. However, with S-Corp taxation, the owner can receive a portion of the income as a salary (which is subject to employment taxes) and the rest as a distribution (which is not), potentially lowering overall tax liability.

Q: Does electing S-Corp status make the LLC a corporation?

A: No, electing to be taxed as an S-Corp does not convert the LLC into a corporation. It is still legally an LLC and governed by state LLC statutes. The S-Corp election affects only how the entity is taxed at the federal level.

Q: How does an LLC make the election to be taxed as an S-Corp?

A: The LLC must file Form 2553 with the IRS, which is the election by a small business corporation. The form must be signed by all shareholders (or members, in the case of an LLC) and submitted within the required time frame, usually within 75 days of the beginning of the tax year for which the election is to take effect.

Q: What are the requirements to qualify for S-Corp taxation?

A: The LLC must meet several eligibility criteria: it must be a domestic entity, have no more than 100 shareholders, have only allowable shareholders (which generally means U.S. individuals, certain trusts, and estates), and it must have only one class of stock. These rules are strictly enforced, and non-compliance can result in the loss of S-Corp status.

Q: Can a multi-member LLC elect S-Corp taxation?

A: Yes, a multi-member LLC can make the election to be taxed as an S-Corp as long as all members are eligible shareholders. The LLC must also comply with the one-class-of-stock requirement, which means profit and loss distributions must be proportionate to ownership interests.

Q: Can a single-member LLC elect to be taxed as an S-Corp?

A: Absolutely. A single-member LLC can elect S-Corp status provided the sole member is an eligible shareholder. The key consideration is whether the tax benefits outweigh the increased administrative obligations.

Q: What are the tax implications of this election?

A: An LLC taxed as an S-Corp is treated as a pass-through entity, meaning that the income is reported on the owners’ individual tax returns, not at the corporate level. However, unlike a standard LLC, the owner must be paid a reasonable salary, and payroll taxes must be withheld and paid. The remaining profits can be distributed without being subject to self-employment tax.

Q: What constitutes a “reasonable salary”?

A: The IRS requires that owners who work in the business receive a salary that reflects the market rate for the services they perform. This is a highly scrutinized area, and underpaying oneself can result in penalties and the reclassification of distributions as wages.

Q: Does electing S-Corp taxation add complexity?

A: Yes, it does introduce additional requirements. The LLC must run payroll, file quarterly payroll tax returns, issue W-2s to owner-employees, and potentially maintain corporate-like formalities to support the election. This added complexity often requires help from a CPA or payroll provider.

Q: Can the S-Corp election be revoked?

A: Yes, an LLC can revoke its S-Corp election by filing a revocation statement with the IRS. This can be done voluntarily if the owners decide the structure is no longer beneficial, or involuntarily if the LLC fails to meet the ongoing requirements.

Q: Are there restrictions on how profits can be allocated in an LLC taxed as an S-Corp?

A: Yes. Because the IRS views an S-Corp as having only one class of stock, profit distributions must be made in proportion to ownership interests. Unlike in a traditional LLC where members can agree to special allocations, that flexibility is limited under S-Corp rules.

Q: How does this affect the LLC’s operating agreement?

A: It’s important to review and potentially revise the operating agreement to ensure it aligns with the S-Corp election. Provisions related to distributions, compensation, and member roles should be carefully drafted to comply with IRS guidelines and avoid inadvertent termination of the S-Corp status.

Q: Do state tax laws align with federal S-Corp treatment?

A: Not always. State tax treatment of LLCs and S-Corps varies. Some states recognize the S-Corp election and tax accordingly, while others do not. Additionally, some states impose separate franchise or gross receipts taxes. It’s important to evaluate the impact at both the federal and state levels.

Q: Should every profitable LLC elect to be taxed as an S-Corp?

A: No. While S-Corp taxation can offer significant savings for some businesses, especially those with consistent profits and active owners, it’s not the best fit for everyone. Businesses with lower profits, passive owners, or those unable to manage the added complexity may not benefit. Each situation should be evaluated individually, ideally with the advice of a tax professional.

Q: Does the election affect liability protection?

A: No. The S-Corp election has no impact on the legal protections provided by the LLC structure. Members continue to enjoy limited liability protection for business debts and obligations, as long as corporate formalities are respected.

Q: What should business owners consider before making the election?

A: Before making the election, owners should consider factors such as expected net income, the owner’s role in the business, the ability to pay a reasonable salary, and the capacity to manage additional compliance obligations. They should also review their business’s long-term goals, funding plans, and operating structure.

Q: What’s the bottom line?

A: Electing to have your LLC taxed as an S-Corporation can be a strategic move to reduce self-employment taxes and retain more earnings. However, it comes with greater administrative responsibilities and stricter IRS rules. It’s not a one-size-fits-all solution and should be approached with careful planning and professional guidance

Need help deciding whether S-Corp taxation is right for your LLC?

The business attorneys at Moore Law are here to guide you through the process and ensure your structure supports your goals. Call us at (615) 747-7467, or use the chat option on our website to get started.

Licensing intellectual property (IP) can be a powerful way to generate revenue, expand brand reach, or collaborate with other businesses. Whether it’s a patent, trademark, or copyrighted material, licensing allows you to retain ownership of your IP while granting others permission to use it under specific conditions. By understanding the different types of licenses and knowing how to structure licensing agreements, you can make the most of your intellectual property while protecting your rights.

Licensing intellectual property is the process of granting another party permission to use your IP rights under agreed terms. As the IP owner (licensor), you maintain ownership, while the licensee gains specific usage rights, which can include manufacturing, distribution, branding, or reproduction of the IP.

Licensing can apply to various types of intellectual property:

The type of license you choose depends on the level of control and exclusivity you want to grant the licensee. Common types of IP licenses include:

Licensing your intellectual property offers several potential benefits:

A licensing agreement is a legal contract that defines the terms and conditions under which the licensee can use the IP. A well-structured agreement protects your interests and provides a clear framework for the licensee’s rights and obligations. Key elements of a licensing agreement include:

Licensing intellectual property can be complex, but following a step-by-step approach can help streamline the process:

Understand the potential revenue and benefits your IP could generate for licensees, and identify target industries or companies that may benefit from licensing it.

Determine the level of exclusivity, territory, and duration that make sense for your business. Consider whether you’re open to sublicensing or limiting the use to a particular field.

Look for companies, individuals, or organizations that align with your goals and can maximize the value of your IP. Research prospective licensees’ reputations, industry experience, and business models to ensure a good fit.

Negotiate key terms, such as royalties, duration, territory, and exclusivity. Be prepared to discuss payment structures, quality standards, and compliance requirements. Working with a legal professional during negotiations can help protect your interests.

Once terms are agreed upon, draft a comprehensive licensing agreement. Ensure that both parties review and understand the document before signing. An attorney with IP experience can help draft a clear, enforceable agreement.

After the agreement is in place, maintain communication with the licensee to ensure compliance with the terms, quality standards, and payment schedules. Regular monitoring helps identify issues early and ensures both parties benefit from the agreement.

While licensing can be profitable, challenges can arise. Here are a few common obstacles:

Licensing intellectual property allows you to leverage your creations without giving up ownership, creating opportunities for revenue generation, market expansion, and brand growth. By selecting the right type of license, drafting a solid licensing agreement, and carefully managing the relationship, you can maximize the value of your IP while ensuring that your interests are protected.

Licensing IP is a legal process, so consulting with an intellectual property attorney can be valuable when drafting or negotiating a licensing agreement. With the right approach and careful planning, licensing can be a powerful tool for unlocking the potential of your intellectual property.

When forming a business, you’ll encounter several legal requirements, one of which is appointing a registered agent. While this step may seem procedural, a registered agent plays a crucial role in your business’s legal and operational structure. For many business owners, the question isn’t just what a registered agent does but also whether they actually need one. Here’s a breakdown to help clarify what a registered agent is, their responsibilities, and why having one is necessary.

A registered agent is an individual or company appointed by a business to receive important legal and tax documents on behalf of the business. Also known as a “resident agent” or “statutory agent” in some states, the registered agent is the official point of contact between your business and the government. This role is essential in ensuring that your business stays compliant with state requirements and that legal documents are handled properly.

The primary responsibilities of a registered agent include:

Nearly every state requires businesses, including LLCs and corporations, to appoint a registered agent as part of the formation process. Here’s why:

The rules around who can act as a registered agent are relatively flexible. Generally, a registered agent can be:

Many business owners wonder if they can handle the role of a registered agent themselves. While it’s possible, it may not always be practical. Here are some pros and cons:

While some small businesses choose to act as their own registered agents, a professional service may be beneficial if:

A registered agent is essential for any business seeking to operate in compliance with state laws. They provide a critical service, ensuring that your business remains aware of important legal, tax, and compliance documents. While it’s possible to serve as your own registered agent, many business owners prefer the peace of mind that comes with hiring a professional service. Not only does this help maintain privacy and ensure consistent availability, but it also allows you to focus on running your business without the added responsibility of managing legal documents.

For businesses operating across state lines or those that value privacy and efficiency, a professional registered agent service can be a worthwhile investment, providing stability and helping prevent legal and compliance oversights.

If you choose Moore Law we will serve as your registered agent, at no cost, for as long as you have your company!

When starting a business, selecting the right legal structure is crucial. Many business owners know about LLCs and corporations, but not everyone understands the differences between an S Corporation (S-corp) and a C Corporation (C-corp). While both share some similarities, like limited liability protection, they have distinct differences in how they are taxed, managed, and operated. Understanding these distinctions can help business owners make a more informed choice about which structure fits their needs.

A C Corporation, or C-corp, is the most common corporate structure in the U.S. When you register a corporation, it is automatically classified as a C-corp unless you elect otherwise. Here are some key characteristics:

An S Corporation, or S-corp, is a corporate structure that allows profits, and certain losses, to pass directly to the owners without being taxed at the corporate level. However, the Internal Revenue Service (IRS) imposes specific requirements on S-corps, making this structure best suited for smaller businesses with a limited number of shareholders.

One of the most significant differences between S-corps and C-corps lies in how they are taxed:

Ownership rules differ between the two types of corporations, with C-corps offering more flexibility:

Both S-corps and C-corps have a similar basic management structure but with slight differences:

In general, C-corps have more formalities, which can benefit larger businesses. S-corps, with fewer restrictions, are typically easier to manage for smaller businesses, especially those operated by a few shareholders.

Deciding between an S-corp and a C-corp depends on your business’s goals, size, and tax considerations:

Choosing the right corporate structure is a crucial decision that impacts your business’s taxation, management, and growth opportunities. C-corps offer more flexibility in ownership and are well-suited for larger companies, especially those looking to attract numerous investors. S-corps, on the other hand, provide tax savings through pass-through taxation and are generally easier to manage, making them a better fit for smaller businesses with limited shareholders.

Each structure has distinct advantages and potential drawbacks, so take time to assess your business goals and consult with a tax or legal professional if needed to ensure the right choice for your company’s future.