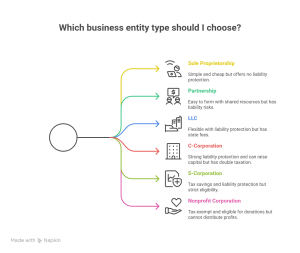

Choosing the Right Business Entity: A Guide for New Entrepreneurs

Your choice of business structure affects your taxes, your personal liability, your ability to raise money, and even how you eventually exit the business. Let’s walk through the most common business entity types, explain what they mean in plain language, and weigh the pros and cons of each.

1. Sole Proprietorship

A sole proprietorship is the simplest and most common way to start a business. It’s essentially just you doing business—no separate legal entity.

Pros:

- Easy and inexpensive to set up.

- Minimal paperwork and compliance requirements.

- You keep all the profits.

Cons:

- No liability protection—your personal assets (like your home or car) are at risk if the business gets sued or goes into debt.

- Harder to raise money since investors and banks prefer more formal structures.

- Business ends if you stop operating.

Best for: Freelancers, consultants, or very small businesses just testing the waters.

2. Partnership

If you’re going into business with one or more people, you may consider a partnership. Partnerships can be general partnerships (GP), where all partners share responsibility, or limited partnerships (LP)/limited liability partnerships (LLP), which give some partners limited liability.

Pros:

- Easy to form, especially a general partnership.

- Flexibility in dividing responsibilities and profits among partners.

- Combined skills, resources, and capital.

Cons:

- In a GP, each partner is personally liable for business debts and for the actions of other partners.

- Potential for disputes if roles and expectations aren’t clearly defined.

- Requires careful drafting of a partnership agreement to avoid conflicts.

Best for: Two or more people who trust each other and want to build something together without too much initial complexity.

3. Limited Liability Company (LLC)

An LLC combines the liability protection of a corporation with the flexibility of a partnership. It’s one of the most popular options for small and medium-sized businesses.

Pros:

- Owners (called “members”) generally aren’t personally liable for business debts or lawsuits.

- Flexible management structure—you can run it yourself or hire managers.

- Profits can “pass through” to owners’ personal tax returns, avoiding double taxation.

- Easier to bring in new members compared to a sole proprietorship or partnership.

- LLCs can also elect to be taxed as an S-Corporation, which can provide additional tax advantages for certain owners.

Cons:

- More expensive and paperwork-heavy to form than a sole proprietorship or partnership.

- Some states charge annual fees or franchise taxes.

- Rules and requirements vary by state, which can create complexity if you operate in multiple states.

Best for: Small to mid-sized businesses that want liability protection but still want flexibility and simplicity.

4. Corporation

A corporation is a separate legal entity from its owners (shareholders). Corporations come in two main types: C Corporations (C-Corps) and S Corporations (S-Corps).

C-Corporation

Pros:

- Strongest liability protection.

- Can raise money more easily through stock sales.

- Perpetual existence—the corporation continues even if owners change.

- Attractive to investors and venture capitalists.

Cons:

- More expensive and complex to form and maintain.

- “Double taxation”: the corporation pays taxes on its profits, and shareholders pay taxes again on dividends.

- Requires ongoing compliance: annual meetings, minutes, and filings.

Best for: Businesses planning to scale significantly, seek outside investors, or eventually go public.

S-Corporation

Pros:

- Pass-through taxation—profits are taxed at the shareholder level, avoiding double taxation.

- Liability protection similar to a C-Corp.

- Potential tax savings on self-employment taxes.

Cons:

- Strict eligibility rules: limited to 100 shareholders, all must be U.S. citizens or residents.

- More administrative requirements than an LLC.

- IRS scrutiny—must pay owners a “reasonable salary” before distributing profits.

Best for: Small to medium businesses that want corporate liability protection with tax advantages.

5. Nonprofit Corporation

If your goal is charitable, educational, or religious rather than profit-driven, you might consider a nonprofit.

Pros:

- Tax-exempt status if approved by the IRS.

- Eligible for grants and donations.

- Limited liability for directors and officers.

Cons:

- Profits must be reinvested in the mission—cannot be distributed to owners.

- Heavy compliance and reporting requirements.

- Complex and lengthy application process for tax-exempt status.

Best for: Organizations formed to serve the public good rather than generate profit.

So, Which One Is Right for You?

There’s no one-size-fits-all answer. If you’re just starting small and want to test your idea, a sole proprietorship or partnership might make sense. If you want liability protection without too much red tape, an LLC is often a great choice. For businesses aiming for rapid growth and outside investment, a C-Corporation is usually the way to go. And if your mission is charitable, a nonprofit may be the right path.

The good news is that your choice isn’t permanent—you can change your business structure later as your company grows. The key is to pick the one that fits your goals, risk tolerance, and vision today.

Pro tip: It’s always smart to consult with a business attorney or accountant before making your final decision. They can help you understand how each option applies to your specific situation.

Frequently Asked Questions (FAQ)

Can I start as a sole proprietorship and change later?

Yes. Many entrepreneurs start as sole proprietors for simplicity and then transition to an LLC or corporation as the business grows and liability risks increase.

Is an LLC always the best choice for small businesses?

Not always. While LLCs offer liability protection and flexibility, some very small businesses may prefer the simplicity of a sole proprietorship, and others might benefit from electing S-Corporation status for tax purposes.

What’s the difference between an LLC and an S-Corporation?

An LLC is a legal entity created at the state level. An S-Corporation is a tax designation that either an LLC or corporation can elect, provided it meets IRS requirements. An LLC can choose to be taxed as an S-Corp, combining liability protection with potential tax savings.

Do I need a lawyer to form a business entity?

Not necessarily, but it’s highly recommended. While you can file forms online yourself, a lawyer ensures compliance with state laws, helps draft agreements, and tailors the structure to your goals.

Which business entity is best for raising venture capital?

C-Corporations are generally preferred by venture capitalists and investors because of their ability to issue different classes of stock and their perpetual structure.

Nathan Moore is a business attorney located in Nashville, Tennessee. Moore Law PC’s entire focus is helping advise and guide entrepreneurs and small business owners in their efforts to be successful in what they do.